Real Estate

30 Israelis make Forbes 2022 billionaires list, led by Miriam Adelson

Luke Tress is an editor and a reporter in New York for The Times of Israel.

Thirty Israelis were listed on the Forbes 2022 billionaires list released on Wednesday, including tech entrepreneurs, shipping magnates and a Hollywood producer embroiled in Benjamin Netanyahu’s corruption trial.

The highest-ranked Israeli was Miriam Adelson, listed as the 50th-richest person in the world with a net worth of $27.5 billion.

Adelson is from Israel, but Forbes placed her in the US in its annual ranking, since she holds American citizenship and lives in Las Vegas.

Adelson debuted on the list in 2021 after her husband, casino mogul Sheldon Adelson, died early in the year. He was a mega-donor to the Republican party and the publisher of Israel Hayom.

Miriam Adelson inherited most of her late husband’s fortune and became the wealthiest new billionaire in the world last year, placing 24th on the Forbest list. She lost around $360 million in the past year.

Eyal Ofer, the head of Ofer Global Holdings, was the wealthiest person in Israel on the list, in 117th place with a fortune of $15.4 billion derived from assets in the real estate and shipping industries.

His brother, Idan Ofer, is the next richest Israeli, in 188th place with $10.5 billion from shipping and energy interests.

The two are the sons of Israeli shipping tycoon Sammy Ofer, who was once Israel’s richest man.

Brothers Dmitri and Igor Bukhman, owners of the gaming company Playrix, were ranked 275th with $8.1 billion.

Arnon Milchan, an Israeli Hollywood film producer and a key witness in Netanayahu’s trial, was the 851st richest person with $3.5 billion.

Adam Neumann, the founder of WeWork, was ranked 2,076th with $1.4 billion. He resigned from WeWork in 2019 after the company’s disastrous IPO attempt, which was partly blamed on his management. That year, he had $4.1 billion.

Roman Abramovich, a Russian who holds Israeli citizenship and had been touted as the richest Israeli, was in 350th place with an estimated net worth of $6.9 billion, down from $14.5 billion last year. He was ranked among 83 Russians on the list.

Forbes said 34 Russians dropped off the billionaires list following the Russian invasion of Ukraine, the biggest drop of any country except China, which lost 87 billionaires due to a government tech crackdown.

Abramovich has been sanctioned by the European Union and the United Kingdom, but not the US.

The world’s richest person was Elon Musk, the founder of Tesla and SpaceX, with $219 billion, followed by Amazon’s Jeff Bezos, with $171 billion.

American tech giants Bill Gates, Larry Page, Sergey Brin, Larry Ellison and Steve Ballmer, as well as US investor Warren Buffet, were also in the top 10.

The Jewish former New York City mayor Michael Bloomberg was 12th, with $82 billion, and Facebook’s Mark Zuckerberg was 15th with $67 billion, down sharply from a year earlier.

Former US president Donald Trump was ranked 1,012 with $3 billion.

Josh Kushner, brother of Jared Kushner, became the first of his family on the list with a net worth of $2 billion from venture capital investments.

There were 2,668 billionaires in the world, 87 fewer than last year, worth a total of $12.7 trillion, Forbes said.

A total of 236 new billionaires were added to the list, including pop star Rihanna and director Peter Jackson, and 329 people fell off the list. The US had the most total entrants, with 735, followed by China, with 607.

The world’s billionaires overall lost $400 billion dollars in the past year.

France’s Francoise Bettencourt Meyers, heiress to the L’Oreal beauty company, was the world’s richest women, listed with her family at 14th place, alongside 327 other women on the list.

The richest self-made woman was China’s Fan Hongwei, who heads chemical supply company Hengli Petrochemical, who was in 88th place with with $18.2 billion.

Israel is now a far more prominent player on the world stage than its size suggests. As The Times of Israel’s Diplomatic Correspondent, I’m well aware that Israel’s security, strategy and national interests are always scrutinized and have serious implications.

It takes balance, determination, and knowledge to accurately convey Israel’s story, and I come to work every day aiming to do so fully.

Financial support from readers like you allows me to travel to witness both war (I just returned from reporting in Ukraine) and the signing of historic agreements. And it enables The Times of Israel to remain the place readers across the globe turn to for accurate news about Israel’s relationship with the world.

If it’s important to you that independent, fact-based coverage of Israel’s role in the world exists and thrives, I urge you to support our work. Will you join The Times of Israel Community today?

Thank you,

Lazar Berman, Diplomatic Correspondent

We’re really pleased that you’ve read X Times of Israel articles in the past month.

That’s why we started the Times of Israel ten years ago – to provide discerning readers like you with must-read coverage of Israel and the Jewish world.

So now we have a request. Unlike other news outlets, we haven’t put up a paywall. But as the journalism we do is costly, we invite readers for whom The Times of Israel has become important to help support our work by joining The Times of Israel Community.

For as little as $6 a month you can help support our quality journalism while enjoying The Times of Israel AD-FREE, as well as accessing exclusive content available only to Times of

Featured

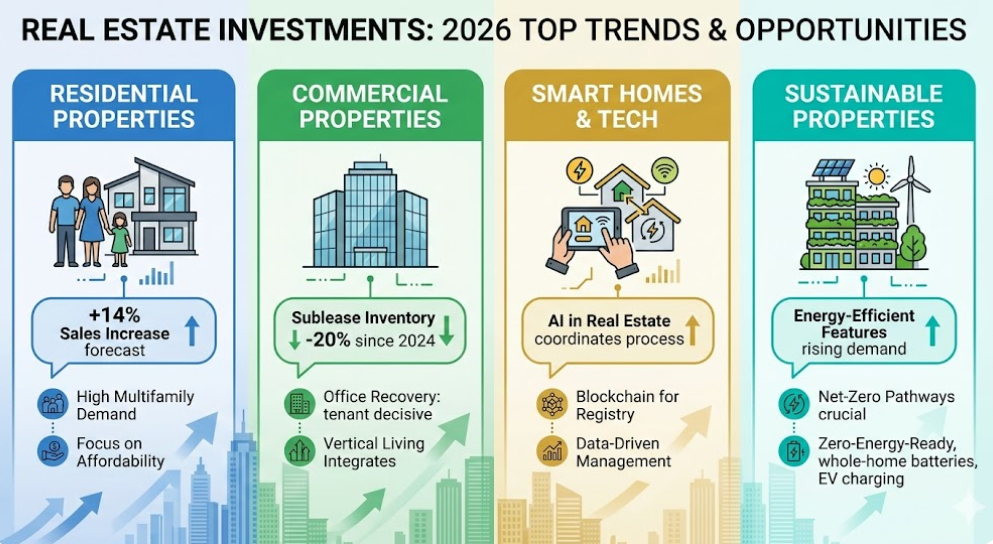

Real Estate Market Trends to Watch in 2026

As we inch closer to 2026, the real estate market is primed for a seismic shift. With technology, sustainability, and evolving societal trends at the forefront, the next few years promise to redefine how we live, invest, and interact with properties. From the surge in smart home technology to the growing demand for eco-friendly buildings, the landscape of real estate is rapidly transforming. But what will it look like in 2026? Whether you’re a seasoned investor, a first-time homebuyer, or just an observer of the market’s pulse, understanding these trends is crucial. Here’s a closer look at the key forces that will shape the real estate market in the years to come.

Real Estate Market Trends to Watch in 2026

As we inch closer to 2026, the real estate market is primed for a seismic shift. With technology, sustainability, and evolving societal trends at the forefront, the next few years promise to redefine how we live, invest, and interact with properties. From the surge in smart home technology to the growing demand for eco-friendly buildings, the landscape of real estate is rapidly transforming. But what will it look like in 2026? Whether you’re a seasoned investor, a first-time homebuyer, or just an observer of the market’s pulse, understanding these trends is crucial. Here’s a closer look at the key forces that will shape the real estate market in the years to come.

Sustainability and Green Building Practices

The call for sustainability in real estate has never been louder. As environmental awareness grows, eco-friendly homes and green building practices are becoming more than just trends—they’re expected to be the norm by 2026. Here’s a breakdown of how sustainability is shaping the real estate market:

- Consumer Demand for Eco-Friendly Homes:

- Energy-efficient homes are no longer a luxury but a necessity for today’s homebuyers.

- Green homes are expected to increase in demand due to rising environmental consciousness.

- Key Features of Sustainable Homes:

- Solar Panels: More homes will feature solar energy systems as cost-effective, sustainable energy sources.

- Energy-Efficient Appliances: Homeowners will prioritize appliances that reduce energy consumption, including high-efficiency HVAC systems and smart thermostats.

- Sustainable Materials: Builders will focus on using sustainable materials such as recycled steel, bamboo, and low-VOC paints to reduce environmental impact.

- Government Incentives and Regulations:

- Governments are expected to offer more rebates and tax credits for sustainable development.

- Stricter building codes and regulations will ensure that new constructions adhere to higher environmental standards.

Urban vs. Suburban Real Estate Shifts

The real estate market in 2026 will continue to see a tug-of-war between urban and suburban living. Let’s explore the factors at play:

- Post-Pandemic Trends:

- The remote work revolution has made suburban areas more attractive, as people seek larger homes and more space for home offices.

- Affordable Housing: Suburbs offer more affordable housing options compared to congested urban areas.

- Urban Revitalization:

- Cities are transforming with mixed-use developments that combine residential, retail, and entertainment spaces.

- Urban areas will evolve to attract young professionals looking for convenience and community.

- Work-from-Home Impact:

- The continued rise of remote work means buyers will prioritize homes that accommodate home offices and outdoor spaces.

- There will be heightened demand for properties with flexible layouts, both in the suburbs and in urban areas.

Real Estate Investment Opportunities

Real estate remains a cornerstone of investment, but the landscape is changing. Here’s where savvy investors will be focusing in 2026:

- Emerging Real Estate Markets:

- Sun Belt Cities: Areas like Phoenix, Austin, and Tampa will see sustained growth due to migration trends and strong job markets.

- Secondary Markets: Smaller, emerging cities are poised for growth as people look to relocate from pricier metropolitan areas.

- Short-Term Rentals:

- Platforms like Airbnb will continue to shape the short-term rental market, with investors focusing on vacation homes and rental properties in popular destinations.

- Investment in vacation rental properties will increase as travelers prioritize unique, home-like experiences over traditional hotel stays.

- Commercial Real Estate Trends:

- Office Space: As remote work becomes permanent for many companies, the demand for traditional office space will decline.

- E-Commerce Growth: The rise in online shopping will lead to increased demand for warehouse spaces and logistics properties.

- Industrial Spaces: A surge in e-commerce and last-mile delivery will spur the growth of industrial real estate investments.

The Impact of Interest Rates and Financing

Fluctuating interest rates and evolving mortgage products will have a significant impact on the real estate market in 2026. Here’s how:

- Interest Rates:

- Higher Interest Rates could lead to decreased buyer purchasing power, affecting affordability and slowing down the pace of transactions.

- Low Interest Rates (if they remain favorable) will incentivize homebuyers and investors to act quickly, but potential rate hikes may curb demand.

- Mortgage Trends:

- More flexible mortgage products will emerge, offering homebuyers more options.

- Adjustable-rate mortgages (ARMs) may become more popular, allowing buyers to lock in lower initial rates.

- Affordability and Financing:

- The real estate market may become less accessible for first-time homebuyers, but government-backed programs could help bridge the gap.

- New lending structures will cater to the diverse financial needs of both buyers and investors, making it easier to secure financing.

What’s Next for Real Estate?

The trends shaping the real estate market in 2026 will have a profound and lasting impact on how we buy, sell, and invest in property. Let’s wrap it up:

- Adapting to the Green Revolution: Sustainable building practices will be the foundation of future real estate development.

- Shifting Preferences: Urban areas will continue to evolve, while suburban living will likely maintain its appeal for families and remote workers.

- Emerging Markets and Investment Opportunities: Investors will keep an eye on emerging real estate markets and short-term rental opportunities, while commercial spaces undergo a transformation.

- Interest Rates: Mortgage and interest rates will play a crucial role in determining the accessibility of real estate, pushing for more flexible financing solutions.

In 2026, real estate will be shaped by adaptability and innovation. Whether you’re looking to buy, sell, or invest, staying ahead of these trends will be essential. With sustainability, technology, and evolving market dynamics at the forefront, the real estate landscape of 2026 will offer plenty of opportunities for those who are prepared.

Ready for the Future of Real Estate?

The real estate market in 2026 is set to undergo transformative shifts that will impact how we live and invest for years to come. As sustainability, technology, and changing social dynamics become the driving forces, those who stay informed and agile will be best positioned to succeed. Whether you’re a homebuyer looking for the perfect green home, an investor eyeing emerging markets, or a developer navigating the evolving demands of urban and suburban living, 2026 promises to be a pivotal year.

Prepare now, adapt to the trends, and position yourself for success in this exciting new real estate era.

Real Estate

American Property Market Forecast: What Buyers Should Know

The American housing market is entering a defining phase—one shaped less by pandemic-era frenzy and more by economic reality. After years of record-low mortgage rates, bidding wars, and runaway price growth, buyers now face a market recalibrating under the weight of higher borrowing costs, constrained supply, and shifting demographic demand. Yet beneath the headlines predicting slowdown or correction lies a more nuanced story.

For prospective buyers, today’s market is not simply about timing a purchase—it’s about understanding where opportunity is quietly emerging. As the U.S. property landscape evolves, informed decision-making may prove to be the single greatest advantage in the years ahead.

Current State of the American Housing Market

The U.S. housing market is transitioning from an era of extraordinary growth into one defined by recalibration and restraint. Following years of aggressive price appreciation and historically low borrowing costs, buyers are now navigating a landscape shaped by higher interest rates and evolving affordability dynamics. While fears of a dramatic correction have largely subsided, the market remains sensitive to economic signals. Today’s environment reflects moderation rather than decline—creating a more deliberate pace for both buyers and sellers.

Key conditions defining the current market include:

- Home prices stabilizing after rapid pandemic-era growth

- Mortgage rates remaining elevated, impacting affordability

- Inventory slowly improving, though shortages persist in major cities

- Buyer demand moderating due to financing pressures

- Greater pricing realism among sellers compared to previous years

Key Factors Shaping the Property Market Forecast

The trajectory of the American property market over the next several years will largely depend on structural economic and demographic forces. Housing trends are no longer driven by a single catalyst but by an intersection of monetary policy, supply constraints, and lifestyle shifts. Understanding these drivers allows buyers to interpret market movements beyond short-term headlines.

Interest Rates and Mortgage Costs

Interest rates continue to act as the market’s primary pressure point. Federal Reserve decisions directly influence mortgage affordability, reshaping purchasing behavior nationwide. Higher borrowing costs have slowed transaction volumes but also helped restore balance to overheated markets.

Major impacts of interest rates include:

- Reduced purchasing power for new buyers

- Increased monthly mortgage payments

- Slower home sales activity

- Greater financial scrutiny among lenders

- Delayed buying decisions for rate-sensitive households

Housing Supply and Construction Trends

Despite recent construction gains, the United States still faces a structural housing shortage years in the making. Builders are responding to demand, yet regulatory challenges and rising development costs continue to limit rapid expansion—particularly in densely populated regions.

Supply-side realities include:

- Expansion of new housing projects in growth states

- Continued shortages in major metropolitan areas

- Rising construction and labor costs

- Limited resale inventory from locked-in low-rate homeowners

- Gradual—but uneven—inventory recovery

Economic Conditions and Employment

Housing demand remains deeply tied to economic confidence. A resilient labor market has prevented widespread housing weakness, even as inflation pressures household budgets. Buyers today are increasingly cautious, prioritizing financial stability before entering long-term commitments.

Economic drivers influencing housing demand:

- Strong employment supporting homeownership demand

- Inflation affecting disposable income

- Consumer confidence shaping purchase timing

- Wage growth partially offsetting higher costs

- Economic outlook influencing lending activity

Migration and Remote Work Trends

Remote and hybrid work arrangements have permanently altered residential decision-making across the United States. Buyers are prioritizing affordability, lifestyle flexibility, and space—fueling growth in markets previously considered secondary destinations.

Migration trends reshaping demand:

- Movement toward suburban and affordable regions

- Population growth across Sun Belt states

- Rising appeal of mid-sized cities

- Reduced dependence on proximity to urban offices

- Expansion of emerging housing markets

American Property Market Forecast: 2026–2028 Outlook

Forecasts for the U.S. housing market suggest a period of normalization rather than dramatic swings. Analysts increasingly expect moderate growth supported by demographic demand and constrained supply. However, outcomes will vary significantly across regions and economic conditions.

Best-case outlook:

- Gradual mortgage rate reductions

- Renewed buyer confidence

- Sustainable home price appreciation

Moderate (most likely) scenario:

- Slow but steady price growth

- Balanced buyer–seller negotiations

- Stable transaction volumes

Risk scenario:

- Prolonged high interest rates

- Regional price corrections

- Economic slowdown pressures

Regional expectations:

- Sun Belt and affordable markets likely to outperform

- Coastal cities may experience slower appreciation

- Rental demand expected to remain strong

- Investment opportunities growing in income-producing properties

What Buyers Should Know Before Purchasing

In today’s recalibrated housing environment, successful buyers are those who prioritize preparation over prediction. Market timing has become increasingly difficult, making financial readiness and long-term planning far more important than chasing short-term trends. Buyers entering the market now must evaluate decisions through both economic and lifestyle lenses.

Practical strategies buyers should follow:

- Lock mortgage rates during favorable market windows

- Focus on long-term ownership horizons

- Evaluate local market data instead of national narratives

- Budget beyond the home price, including:

- Property taxes

- Insurance premiums

- Maintenance costs

- Closing and financing expenses

- Purchase based on readiness—not market speculation

Opportunities and Risks for Buyers

As market conditions normalize, buyers are regaining leverage absent during the pandemic boom. Increased inventory and reduced competition are creating entry points that were previously difficult to access. However, uncertainty surrounding interest rates and economic performance continues to demand caution.

Opportunities emerging for buyers:

- Improved negotiation power

- Increased housing availability

- Fewer bidding wars

- Long-term appreciation potential

Key risks to monitor:

- Mortgage rate volatility

- Localized market corrections

- Economic slowdown impacts

- Affordability fluctuations

Why Timing Matters Less Than Strategy

The American housing market is entering a phase where informed strategy outweighs short-term timing. Rather than signaling decline, current conditions reflect a market returning to sustainable fundamentals. Buyers who approach real estate with discipline, research, and long-term perspective are positioned to benefit most. As economic conditions evolve, those who understand market cycles today may ultimately secure stronger financial and lifestyle returns in the years ahead.

Featured

Ron Holloway Is Helping Everyday People Build Wealth Through Land Deals — One Blueprint at a Time

In a world where real estate often feels out of reach for everyday people, Ron Holloway, developer, coach, and founder of New Hope Builders, Inc, is proving that with the right strategy, anyone can get in the game.

With more than two decades of experience, Ron has built a million-dollar empire, closed over eight figures in real estate deals, and developed more than 100 homes across Virginia and beyond. But what truly sets him apart is his passion for teaching others how to do the same—no matter their background or starting point.

“Most people look at an empty lot and just see dirt,” Ron says. “I see opportunity. And my mission is to show people how to turn that dirt into dollars, deals, and legacy.”

From Developer to Educator

Ron’s journey began as a hands-on builder and investor. Over the years, he developed a keen eye for spotting profitable land opportunities—often before anyone else saw the potential. Through trial, error, and strategic planning, he built a thriving business and became known for his ability to break down complex real estate concepts into clear, actionable steps.

Now, through workshops, coaching programs, and his newly released book, Ron is sharing his exact methods with aspiring investors, entrepreneurs, and coaches who want to build wealth through land development.

Launching “From the Dirt to the Keys”

Ron’s new book, From the Dirt to the Keys: The Blueprint to Profitable Land Deals & Dream Homes, officially launched on October 18, 2025, at the Russell Innovation Center for Entrepreneurs in Atlanta, Georgia.

The event was more than a book signing—it was a hands-on workshop where attendees learned how to evaluate land, run profit numbers, and create their own real estate strategies. Ron also introduced his 4-Week Coaching Intensive, designed to help participants put the blueprint into action immediately.

Making Real Estate Accessible

Ron’s approach is refreshingly practical. Instead of overwhelming people with jargon, he focuses on clear steps:

- Step 1: Start with zoning and land fundamentals.

- Step 2: Run quick, realistic numbers.

- Step 3: Know your exit strategy before you buy.

This framework has already helped countless individuals take their first steps toward profitable land deals—many of whom had zero real estate experience beforehand.

A Mission Rooted in Legacy

For Ron, this work is bigger than business. It’s about creating generational wealth and empowering communities to invest strategically.

“My goal is simple,” Ron explains. “I want to make real estate investing accessible. If you have the willingness to learn, I have the blueprint to help you win.”

To learn more about Ron Holloway and get a copy of his new book, visit: www.FromTheDirt2TheKeys.com

-

Featured1 year ago

Featured1 year ago20 Entrepreneurs to Watch Closeout 2024

-

Innovation2 years ago

Innovation2 years agoLeo Horacio: A Successful Entrepreneur in the Ecommerce and Online Sales Industry

-

Innovation2 years ago

Innovation2 years agoInnovators in Social-Emotional Learning: Dr. Myava Clark and Chris Clark Jr.

-

Music2 years ago

Music2 years agoArtist Deydee Signs $350,000 Contract with Rueda Empire LLC

-

Latest2 years ago

Latest2 years agoCharles zhang recognized by forbes as #1 on michigan’s 2022 best in state wealth advisor list

-

Uncategorized1 year ago

Uncategorized1 year agoTrailblazer in Business: Alicia Fitts on Building Wealth and Community Through Faith

-

Latest1 year ago

Latest1 year agoFlorida Gov DeSantis signs 15-week abortion ban | Latest News

-

Lifestyle2 years ago

Lifestyle2 years agoPhillip Austin brings outlaw country to General Duffy’s stage – The Bulletin