Money

Riding the Storm: How the 2024 Hurricane Season is Shaking Up the Economy

Hurricanes are nothing new, but the 2024 season is ramping up to be one of the most intense in recent years. With forecasts predicting between 27 and 39 named storms, including three hurricanes likely to make landfall in the U.S., the economic fallout is expected to be massive. This year, the challenge isn’t just the storms themselves, but their lingering effects on an already vulnerable economy dealing with inflation, supply chain issues, and ongoing recovery efforts from previous disasters.

The National Oceanic and Atmospheric Administration (NOAA) estimates that each hurricane costs about $22.8 billion. Beyond just the initial destruction to homes, businesses, and infrastructure, hurricanes bring an economic ripple effect that lasts far longer than the storm. Supply chains get disrupted, leading to shortages of goods and services. Businesses shut down, some permanently, and local economies stall as workers are displaced or forced into unemployment. On top of that, the cost of rebuilding infrastructure and communities runs into billions, while insurance claims from these disasters strain the financial sector.

When a hurricane hits, the immediate impacts on employment are staggering. Power outages, transportation shutdowns, and flooded businesses leave many people out of work. According to research, each unemployed American loses about $1,634 per week. Multiply that by thousands of displaced workers, and you can imagine how quickly these numbers add up. It’s estimated that if just 100,000 people can’t work for a single week after a hurricane, the economy could lose around $2.4 billion in output.

But here’s the irony—while hurricanes destroy, they also spark economic activity. As communities begin the recovery process, there’s a surge in job creation. Construction and repair jobs boom, and demand for services like retail, maintenance, and transportation spikes. According to one analysis, for every dollar spent on hurricane repairs, the economy gets a return of $1.72. So, while a storm might initially cause a $22.8 billion hit, the recovery process injects billions back into the economy by supporting jobs, raising incomes, and stimulating spending

In 2024, recovery efforts from these expected hurricanes could generate up to $181.7 billion for the U.S. economy. This might sound like a good thing, but the gains come at a huge price. Lives are disrupted, homes and businesses are destroyed, and entire communities have to rebuild from the ground up. Recovery is not instant, and even though it can spur economic growth, the human and social costs are overwhelming. The hit to industries like tourism, hospitality, agriculture, and energy is severe, with many businesses facing months or even years before they can fully recover.

The economic impacts of hurricanes are complex and often misunderstood. While they might bring a temporary boost to certain sectors, like construction, the long-term costs outweigh the benefits. Hurricanes are a costly reminder of the importance of disaster preparedness and resilient infrastructure. Governments, businesses, and individuals must invest in disaster-resistant buildings, better storm warning systems, and quicker recovery protocols. Doing so can mitigate both the human and economic costs of these increasingly frequent storms.

As we head deeper into the 2024 hurricane season, the focus should be on how to manage both the immediate destruction and the economic aftershocks. While the economy might eventually bounce back, the losses—both financial and personal—are real. Natural disasters like hurricanes underscore the need for smarter infrastructure and more effective response strategies to ensure communities can recover as quickly and as safely as possible.

Money

Financial Planning Tips for Young Professionals

In today’s fast-paced world, young professionals are often caught in the whirlwind of career growth, networking, and personal aspirations. But amidst the hustle, one thing often gets pushed to the back burner: financial planning. If you’re in your 20s or 30s, it’s easy to think you have time—after all, retirement seems like a distant dream. But here’s the hard truth: the sooner you start managing your finances, the more powerful your wealth-building potential becomes. Financial planning isn’t just about avoiding debt or saving for a rainy day—it’s about creating the foundation for the life you want.

In this article, we’ll dive into actionable financial strategies that will not only keep you afloat today but pave the way for long-term financial freedom. Get ready to take control of your financial destiny before it takes control of you.

Start with a Budget: The Blueprint to Financial Success

One of the most basic yet powerful tools for financial success is budgeting. Without a clear understanding of where your money is going, it’s impossible to make informed decisions. Here’s how to get started:

- Track your income vs. expenses: Understand what’s coming in and where it’s going.

- Categorize your spending: Identify essential vs. non-essential expenses (e.g., rent, utilities, dining out).

- Use budgeting tools:

- Apps like Mint, YNAB (You Need A Budget), or a spreadsheets are great options for tracking.

- Set limits on discretionary spending: Decide in advance how much you want to spend on things like entertainment, shopping, and dining out.

Tip: Even if it’s just a few dollars, always save something. Every dollar saved now can be invested later.

Build an Emergency Fund: The Safety Net You Can’t Afford to Ignore

Life is unpredictable—whether it’s an unexpected medical bill, job loss, or car repair. This is where an emergency fund can be a game-changer. Here’s why it’s essential and how to build one:

- Why it matters: An emergency fund ensures you’re not digging into credit cards or loans during a financial crisis.

- How much to save: Aim for 3-6 months’ worth of living expenses.

- Where to keep it: Use a high-yield savings account to grow your emergency fund with interest while still keeping it liquid.

Tip: Start small if necessary. Set up automatic transfers to your emergency fund each payday.

Pay Off High-Interest Debt: The Silent Wealth Killer

High-interest debt is like a financial anchor, holding you back from financial growth. To escape this trap:

- Prioritize high-interest debt: Start with credit card balances and payday loans, which can spiral quickly.

- Two popular methods to pay off debt:

- Avalanche method: Pay off the highest-interest debt first.

- Snowball method: Pay off the smallest debts first to build momentum.

- Understand your credit score: A healthy credit score is key to securing better loans and rates in the future.

Tip: Once the high-interest debts are cleared, the extra cash can be used for savings or investments, putting you on the path to wealth-building.

Invest Early: Let Compound Interest Work Its Magic

The sooner you start investing, the more time your money has to grow—thanks to compound interest. Here’s how to make the most of it:

- Start with retirement accounts:

- 401(k): Take advantage of employer contributions (free money).

- Roth IRA: Enjoy tax-free growth and withdrawals in retirement.

- Diversify your investments: Mix low-cost index funds, ETFs, and individual stocks.

- Avoid trying to time the market: Consistent investing over time beats short-term market predictions.

Tip: Even small contributions add up. Set up automatic contributions to your retirement accounts and invest regularly.

Plan for Retirement: It’s Never Too Early

Retirement may feel far off, but the earlier you start saving, the easier it will be to maintain your lifestyle later. Here’s how to start:

- Contribute to retirement accounts:

- 401(k) and IRA: Take advantage of tax benefits and employer matching contributions.

- Consider a Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free in retirement.

- Remember the power of compound interest: The earlier you start, the more your money will grow by the time you retire.

Tip: Don’t wait for “perfect” conditions. Start contributing now, and increase your contributions as your salary grows.

How to Make It All Happen: The Next Steps in Your Financial Journey

Financial planning isn’t a one-and-done checklist; it’s an ongoing process that requires intentionality and consistency. Here’s how you can make it work:

- Start with a budget to track your spending.

- Build an emergency fund so you’re prepared for unexpected expenses.

- Pay off high-interest debt to free up cash for investing and savings.

- Invest regularly in a diversified portfolio to build long-term wealth.

- Plan for retirement with tax-advantaged accounts like a 401(k) and IRA.

Take Action Today for a Stronger Financial Future

Financial planning doesn’t have to be overwhelming, but it does require discipline and commitment. As a young professional, your biggest advantage is time. The earlier you begin, the more you can take advantage of compounding and long-term growth. By starting with small, consistent steps—like budgeting, building an emergency fund, and paying off high-interest debt—you’ll be positioning yourself for financial success. Don’t wait until it’s “too late.” Every decision you make today lays the groundwork for your financial future. So take action now, and your future self will thank you.

Money

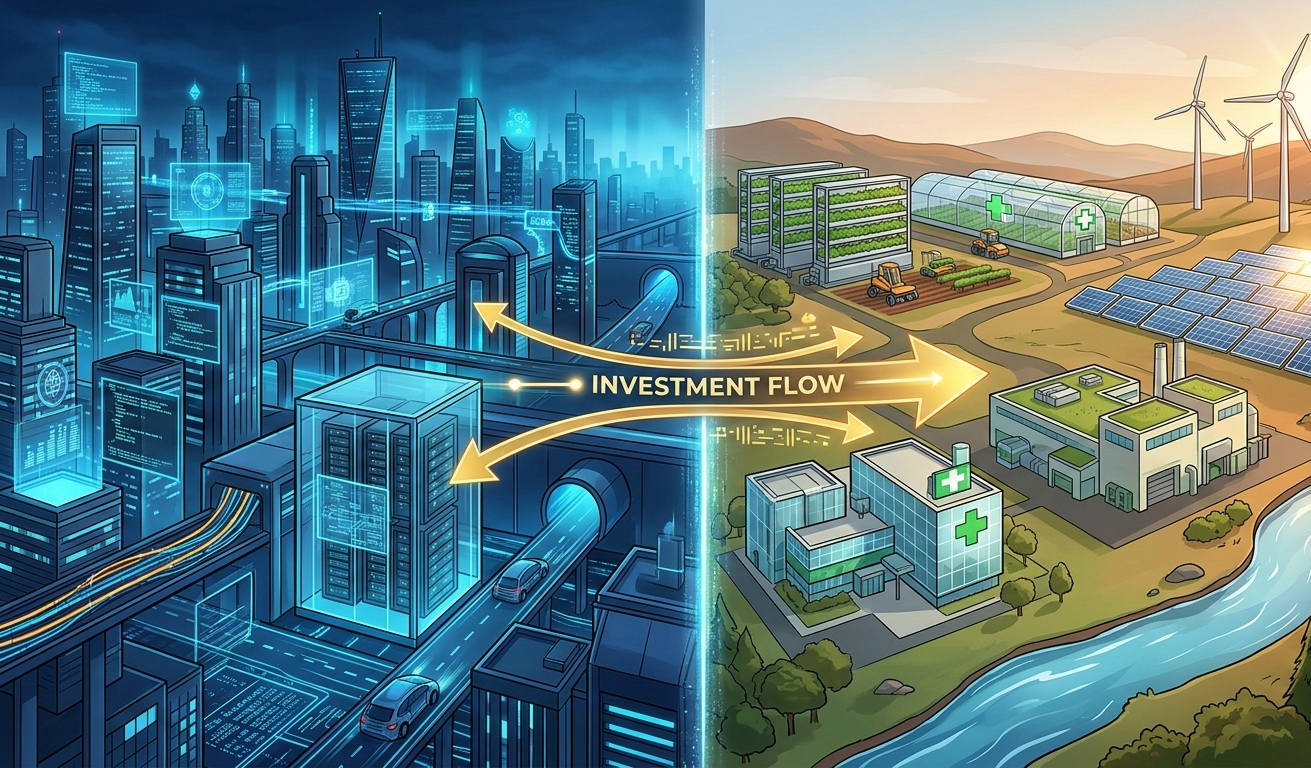

Big Shift: Investors Moving Away from Pure Tech

In recent years, a seismic shift has quietly taken place in the world of investing. For over a decade, technology stocks were the golden ticket—driving sky-high returns and attracting legions of investors eager to ride the wave of innovation. But as the dust settles on a post-pandemic world, a new trend is emerging: Investors are fleeing from pure tech in droves. The once-unstoppable giants of Silicon Valley are now facing growing skepticism, while sectors once considered secondary are rapidly rising in appeal. So, what’s behind this dramatic pivot? And more importantly, what does it mean for the future of global markets? Welcome to the new investment frontier—one where diversification, stability, and sustainability are taking center stage, and the all-consuming dominance of pure tech may finally be a thing of the past.

Changing Market Dynamics

The investment world is evolving, and the tech sector is no longer the sole powerhouse driving returns. Here’s why:

- Market Saturation:

- Many tech companies have reached maturity, with limited opportunities for explosive growth.

- Stocks from companies like Apple and Microsoft continue to perform well, but their massive market caps slow their ability to achieve the rapid growth seen in previous years.

- Post-Pandemic Adjustments:

- During the pandemic, tech stocks soared as consumers flocked online, but now the market is facing a correction.

- Overvaluations that peaked during the pandemic have come under scrutiny, and investors are re-evaluating their portfolios.

- Macroeconomic Factors:

- Inflation: Rising inflation is leading to increased costs for tech companies, decreasing profitability.

- Interest Rates: Higher interest rates make borrowing more expensive, making it harder for tech companies to fund their growth at the same pace.

- Global Economic Instability: Political and economic uncertainty worldwide is prompting investors to pull back from high-risk sectors like tech, seeking safer investments.

Emerging Alternatives to Pure Tech

As investors look to diversify their portfolios, they are turning to sectors that promise growth and stability:

- Healthcare:

- With an aging global population and the ongoing demand for innovation in medical technology, healthcare stocks, particularly in biotech, are seeing increased interest.

- Renewable Energy:

- The climate crisis has accelerated investment in sustainable energy. Investors are flocking to companies in solar, wind, and battery technologies.

- Finance & Fintech:

- The rise of digital banking, decentralized finance (DeFi), and blockchain technology has created a new wave of investment opportunities.

- Infrastructure:

- As governments worldwide continue to focus on rebuilding infrastructure, companies in construction, transportation, and utilities are becoming more attractive to investors.

- Focus on ESG (Environmental, Social, Governance):

- ESG-focused companies are gaining traction. Investors are looking for companies that prioritize sustainability, ethical governance, and social responsibility.

- Sustainable investments are no longer a niche—they’re a mainstream priority for the modern investor.

- Real Estate & Commodities:

- Real estate and commodities such as gold and oil are seen as safer, more tangible investments in volatile times.

- These sectors are experiencing a resurgence as investors seek stability amid the uncertainty in the tech sector.

Why the Shift?

Several key factors are driving investors away from pure tech:

- Valuation Concerns:

- Tech overvaluation: Many tech stocks are perceived as overpriced, leading investors to seek more attractive opportunities in undervalued or emerging sectors.

- Risk Management:

- As tech stocks become more volatile, investors are diversifying to reduce risk and find stability in other sectors.

- Changing Investor Preferences:

- Younger investors, more focused on sustainability and long-term value, are moving away from high-risk tech investments in favor of companies that align with their values.

The Future of Tech Investment

Despite the shift, tech is far from disappearing from investor portfolios. Here’s what to expect in the coming years:

- Tech’s Vital Role:

- Technologies like AI, quantum computing, and the Metaverse will continue to drive innovation and attract investment.

- Hybrid Investment Models:

- Tech + Other Sectors: Investors will increasingly favor mixed portfolios that combine tech with other industries such as healthcare, infrastructure, and renewable energy. This balance will allow investors to maintain exposure to innovation while mitigating risk.

- A diversified investment strategy will be key to maintaining strong returns without the volatility typically associated with pure tech.

The Road Ahead: A Changing Investment Landscape

The shift away from pure tech is not merely a fleeting trend—it’s a reflection of the broader transformation occurring in the world of investments. As investors seek diversification, stability, and long-term growth, traditional tech dominance is giving way to a more balanced approach. While sectors like healthcare, renewable energy, and infrastructure emerge as solid alternatives, the tech industry will continue to play a crucial role in shaping the future, especially with the rise of AI, quantum computing, and other groundbreaking technologies.

However, the key to success in the new investment landscape will lie in a hybrid model—one that combines tech with other industries, mitigating risks while still capitalizing on innovation. As younger generations of investors place greater emphasis on sustainability and values-driven portfolios, the focus will shift toward companies that not only promise financial returns but also contribute to solving global challenges. For investors, this is an exciting opportunity to build a more diversified and resilient portfolio, one that balances the promise of technology with the stability of other emerging sectors. The future of investing is here, and it’s more dynamic, diverse, and sustainable than ever before.

Featured

Rising Gas Prices: What’s Driving the Increase and What It Means for Drivers

Gas prices across the United States are rising again, and experts say several economic and global factors are pushing costs higher at the pump. While prices haven’t reached the extreme highs seen in past years, the trend is clear: drivers should expect to pay more for gasoline in the weeks ahead.

Global Events and Oil Market Impact

Recent U.S. and Israeli military strikes on Iran have rattled global oil markets, contributing to rising crude oil prices — the largest single factor in determining what drivers pay for gas. After these strikes, global oil prices jumped, and analysts anticipate continued pressure on markets as tensions remain elevated in the Middle East. Oil is a key ingredient in gasoline, so when crude prices rise, retail gas prices typically follow.

A significant concern among energy experts is the Strait of Hormuz, a strategic waterway through which a large share of the world’s oil supply passes. If disruptions continue there, global oil supplies could tighten, further boosting gasoline costs worldwide.

Seasonal Trends and Production Costs

Gas prices normally rise this time of year due to a seasonal switch to summer-blend gasoline, which is required by environmental regulations and costs more to produce. Refineries begin making this blend in late winter and early spring, adding to upward pressure at the pump.

In addition to crude oil costs and seasonal shifts, gasoline prices also incorporate refining, distribution, marketing, and taxes. These components can vary by region and affect how much drivers pay for each gallon.

Current Price Levels and Expectations

According to recent pricing data, the national average for a gallon of regular gasoline increased to around $2.98 in late February, with prices rising week after week. This increase comes as energy markets adjust to global developments and growing demand as the travel season approaches.

Energy analysts now warn that average gas prices could exceed $3 per gallon in the coming weeks if crude oil continues to strengthen and geopolitical risks persist.

What This Means for Consumers

- Daily commuting costs: Drivers may see higher fuel bills with each fill-up as prices climb.

- Travel planning: Summer and spring break travel could become more expensive due to more expensive gasoline.

- Broader inflation: Higher energy costs can ripple through the economy, increasing costs for goods and services tied to transportation.

Gas prices are trending upward due to a mix of global geopolitical tensions, seasonal production changes, and normal market factors that influence fuel costs. While the increase is gradual for now, experts say conditions could push prices higher if oil markets remain unstable. Keeping an eye on pricing trends and adjusting travel or budget plans can help drivers prepare for continued fuel cost increases.

-

Featured1 year ago

Featured1 year ago20 Entrepreneurs to Watch Closeout 2024

-

Innovation2 years ago

Innovation2 years agoLeo Horacio: A Successful Entrepreneur in the Ecommerce and Online Sales Industry

-

Innovation2 years ago

Innovation2 years agoInnovators in Social-Emotional Learning: Dr. Myava Clark and Chris Clark Jr.

-

Music2 years ago

Music2 years agoArtist Deydee Signs $350,000 Contract with Rueda Empire LLC

-

Latest2 years ago

Latest2 years agoCharles zhang recognized by forbes as #1 on michigan’s 2022 best in state wealth advisor list

-

Uncategorized1 year ago

Uncategorized1 year agoTrailblazer in Business: Alicia Fitts on Building Wealth and Community Through Faith

-

Latest1 year ago

Latest1 year agoFlorida Gov DeSantis signs 15-week abortion ban | Latest News

-

Lifestyle2 years ago

Lifestyle2 years agoPhillip Austin brings outlaw country to General Duffy’s stage – The Bulletin