Small Business

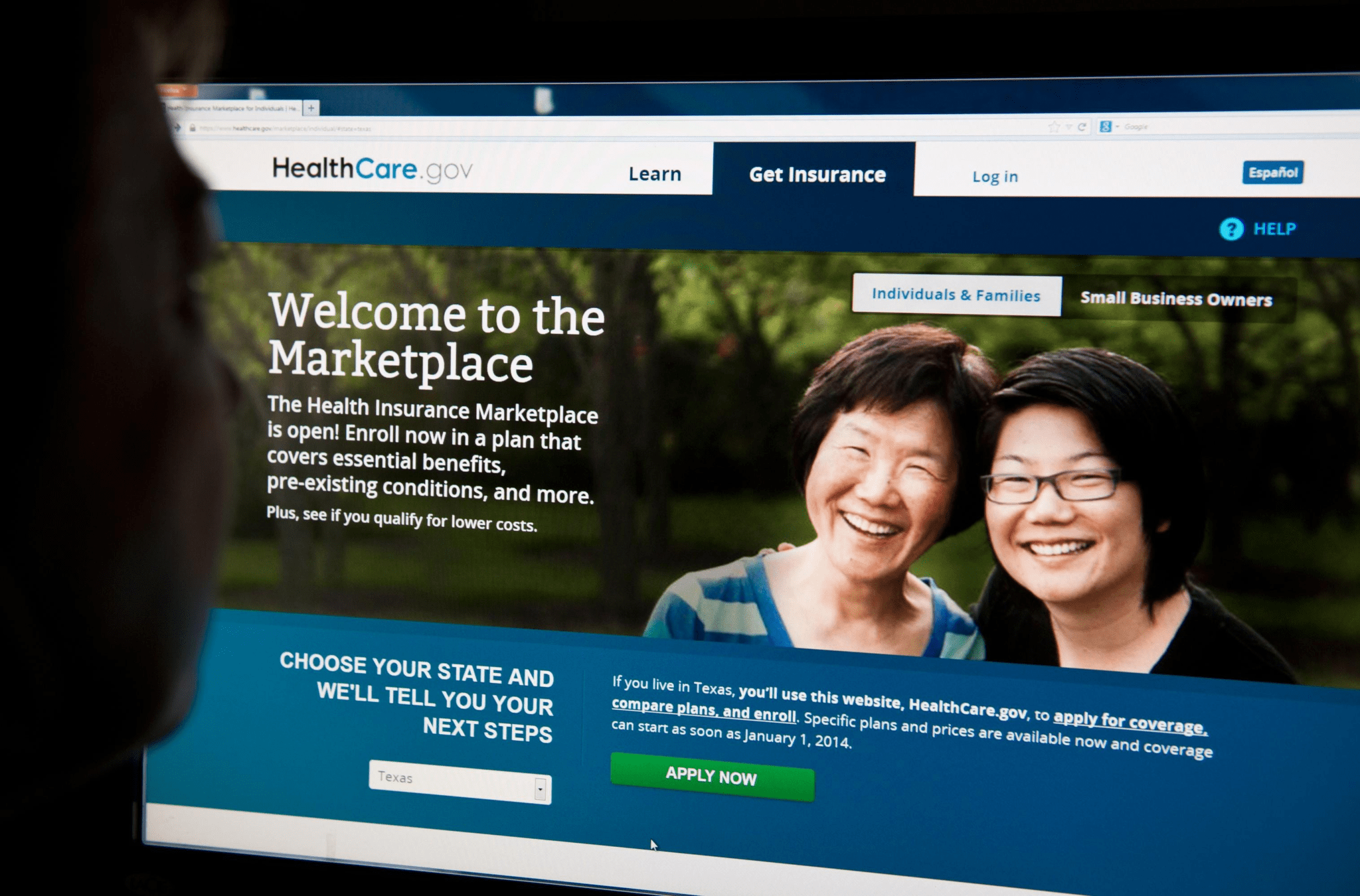

Healthcare.Gov: Three Things Small Business Owners Should Know – Forbes

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius.

AFP PHOTO / Karen BLEIER (Photo credit should read KAREN BLEIER/AFP via Getty Images)

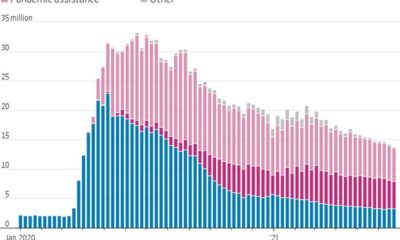

The past year has been one of the most challenging in American history, especially for small business owners. Not only was staying financially afloat difficult, but a public health crisis exacerbated the many challenges of running a small business, maintaining healthcare coverage and all that comes with it. A May Small Business for America’s Future survey of more than 1,000 small business owners found that 75% said providing health coverage to employees has increased over the last four years and nearly one in three small business owners have considered dropping coverage with the most prevalent reason being high costs.

In this context, small businesses across the country may be considering what’s next. The same pandemic that created many of these challenges has also shown the importance of public health, healthcare and the new coverage options under the Affordable Care Act (ACA) that help small business owners and their employees access coverage.

In fact, the Affordable Care Act (ACA) made healthcare coverage accessible to millions of individuals, small business owners and their employees who otherwise could not afford it. President Biden’s American Rescue Plan (ARP) then broadened eligibility under the ACA and added tax credits for health insurance, making obtaining coverage more accessible and affordable than before. Even with these benefits, small business owners still have to navigate their diverse needs in providing coverage to employees, such as tax credits and finding the right plan, while also running a business.

Here are three things small business owners should consider about getting coverage under the ACA.

1. The SHOP Marketplace is Tailored to Small Businesses Health Insurance Plans

The Small Business Health Options Program (SHOP) Marketplace provides detailed guidance on the type of plans that are available through Healthcare.gov to small businesses that have less than 50 full-time employees. The plans provide quality, affordable health and dental insurance, but also give small employers a choice and flexibility in selecting the right coverage for their employees. The Small Business Administration (SBA) offers a resource for understanding the options available to small business owners and self-employed individuals in 36 states, five U.S. territories, and the District of Columbia using the HealthCare.gov platform.

2. SHOP Plans are the Best Avenue for Receiving the Small Business Health Care Tax Credit

The SHOP plans are also generally the only way to qualify for the Small Business Health Care Tax Credit, which can be worth up to 50% of an employer’s contribution to premium costs. There are a number of requirements for obtaining the credit, but it is generally available to businesses with 25 for fewer employees who have a SHOP plan.

3. Self-Employed Individuals can also Purchase Plans on Healthcare.gov

Self-employed individuals such as gig workers, freelancers, consultants, independent contractors, and business owners with no employees can also purchase coverage on Healthcare.gov. For self-employed individuals who were not able to qualify for coverage in the past, it is important to note that the ARP broadened eligibility for coverage so they may now qualify. Most people currently enrolled in a Marketplace plan may qualify for more tax credits, making health insurance premiums after these new savings lower than ever before.

Small business owners often work at least 12 hours a day just to keep the lights on and operations running. Whether you are self-employed and check out the individual Marketplace or a small employer who checks out the SHOP Marketplace — it can be an easier option for them to select the right health coverage options for their business and employees and SHOP-registered agents and brokers are also available to help.

Employers can visit healthcare.gov/small-businesses/ to learn more.

Leadership

Bridging the Wealth Gap Through Government Contracts: The Vision of Dr. Karwanna D. Irving

Dr. Karwanna D. Irving is a transformational speaker, author, and nationally recognized business coach who has built her career on helping six-figure entrepreneurs scale to seven figures by leveraging one of the most powerful yet underutilized revenue streams available: government contracts. With more than twenty years of experience spanning entrepreneurship, leadership development, and strategic growth, Dr. Irving has positioned herself as a trusted authority in teaching business owners how to successfully sell to the world’s largest buyer, the U.S. government.

Throughout her career, Dr. Irving has empowered more than7,000 entrepreneurs, executives, and business leaders to move beyond traditional income ceilings and step into sustainable, scalable growth. Her approach combines strategic clarity, practical execution, and mindset transformation, allowing her clients to confidently pursue lucrative public sector opportunities without sacrificing their vision or values. Known for translating complex government contracting processes into clear, actionable steps, she has helped countless businesses expand their reach, increase profitability, and create long-term financial stability.

Dr. Irving’s impact and leadership have been widely recognized. She is a recipient of the 2024 Stevie Awards in Business and the prestigious 2025 Enterprising Woman Award, honoring her influence as both a business strategist and a champion for economic equity. Her work has been featured in Success Magazine, and the San Francisco Business Times named her firm among the Top 100 Fastest Growing Bay Area Private Companies. Further solidifying her standing as an industry leader, Dr. Irving’s company ranked #1680 on the Inc. 5000 list of 2025 Fastest Growing Private Companies in America.

Beyond accolades, Dr. Irving is deeply committed to bridging the wealth gap by equipping six-figure business owners with the knowledge and confidence needed to unlock multi-million-dollar opportunities. She believes access to government contracts can be transformative not only for individual entrepreneurs, but for families, communities, and future generations. Through speaking engagements, coaching programs, and educational challenges, Dr. Irving continues to inspire business owners to think bigger, execute smarter, and build enterprises that create lasting impact.

Special thanks to Dr. Karwanna’s Sponsor

San Francisco African American Chamber of Commerce

Website: www.sfaacc.org

What’s New: Major Momentum and Opportunities Emerging in the Last Three Months

Over the past three months, the momentum within my business has been nothing short of incredible, and I am excited about the opportunities we are now opening for business owners at a higher level. One of the most significant developments is the re-launch of our five-day challenge designed specifically to help business owners, entrepreneurs, and high-level executives add an additional six to seven figures by securing lucrative government contracts. This initiative was created in response to the growing demand from entrepreneurs who are ready to scale but are hitting a ceiling in the private sector.

What makes this challenge different is its focus on real strategies, real opportunities, and real execution. Participants are not just learning theory. They are gaining clarity on how government agencies buy, how to position their businesses correctly, and how to confidently pursue contracts that align with their existing services. In a time when many businesses are experiencing uncertainty in traditional markets, government contracting offers stability, consistency, and long-term growth, and this challenge meets business owners exactly where they are.

Another exciting development is the expansion of our educational framework to support more advanced entrepreneurs who are already earning six figures and want to transition into seven-figure government opportunities. We are seeing an increase in executives and established founders who recognize that government contracts are not just an add-on but a strategic growth pillar. This evolution reflects our commitment to meeting our community at every stage of growth while continuing to elevate the conversation around wealth creation, access, and sustainability.

For those ready to take advantage of these opportunities, the upcoming five-day challenge is the perfect entry point. Business owners can learn more and secure their spot by visiting ContractsToMillions.com, where the next level of scaling begins.

Looking Ahead: What’s Coming in the Next Few Months

In the coming months, my focus remains on expanding access to education, strategy, and execution around government contracting at scale. The centerpiece of this effort is our upcoming five-day challenge, which will serve as both an intensive learning experience and a catalyst for long-term growth. This challenge is designed for business owners, entrepreneurs, and high-level executives who are serious about adding six to seven figures in revenue and are ready to move with intention.

During the challenge, participants will gain insight into how government agencies source vendors, how to align their current offerings with public sector demand, and how to build credibility quickly in a highly competitive space. We will also address mindset barriers that often prevent entrepreneurs from pursuing government contracts, such as fear, misinformation, or the belief that these opportunities are out of reach. My goal is to demystify the process and empower participants with clarity and confidence.

Beyond the challenge itself, this initiative sets the stage for deeper engagement and continued support for those ready to fully integrate government contracting into their business model. The upcoming months will also include expanded resources, strategic partnerships, and advanced training opportunities designed to help entrepreneurs move from learning to implementation without unnecessary delays.

For anyone who knows they are capable of more and is ready to pursue stable, scalable revenue, now is the time. The upcoming five-day challenge provides a powerful starting point for transforming how business owners think about growth and opportunity. More details and registration information can be found at ContractsToMillions.com.

Contact Information

- Email: karwanna1@gmail.com

- Website: www.ShesGotGoals.com

- Facebook: https://facebook.com/IAMKARWANNAD

- Instagram: @karwannadspeaks

- LinkedIn: https://linkedin.com/in/karwannadspeaks/

Small Business

From Book to Bank: How to Turn Your Story Into a 6-Figure Business

Everyone wants to write a book. But let’s be real—most people don’t make a dime from it. They sell 100 copies, get a few likes, and then go broke promoting it. Cute, but not profitable.

If you’re writing a book just to say, “I’m an author,” that’s fine. But if you want your book to fund your lifestyle, grow your brand, and bring in consistent income, then keep reading.

1. Stop Chasing Sales—Chase Strategy

Forget selling copies one by one. Smart authors use their book to lead people to something bigger—like coaching, consulting, speaking, or premium products. Your book is the appetizer. The real money? That’s in the main course.

2. Build a Business Around Your Book

Don’t just sell a story—sell a system. Create a course, a group program, or a done-for-you service tied to your book’s message. If your book solves a problem, people will pay you to solve it faster.

3. Use Your Book as a Funnel

Your book should always point somewhere—like a landing page, calendar link, or private community. This is how readers become leads, and leads become clients.

4. Get on Stages & in Rooms

Books open doors. Period. If you position it right, you’ll land media interviews, get on podcasts, and get paid to speak. Even if you’re not famous—your book gives you authority.

Bottom line? Books don’t make you rich. Business does. But a well-positioned book can be the key to building a six-figure (or more) empire.

Featured

Transforming Your Expertise into Income

By Dr. Stevii Aisha Mills

Let’s explore an empowering concept: how to turn your knowledge and skills into a profitable income stream. The idea behind “Click To Cash” is simple yet profound: you can leverage your expertise to create value for others, and in return, earn income.

Recognizing Your Unique Value

We often underestimate the power of our experiences and knowledge. Whether it’s skills developed in your career, hobbies you’re passionate about, or life lessons learned, you possess unique insights that others may find valuable. Understanding this is the first step toward monetizing your expertise.

Take a moment to reflect on what you excel at. What are the skills and knowledge areas you’ve developed over the years? What advice do friends or colleagues frequently seek from you? Recognizing your strengths will help you see the potential for turning those abilities into income.

Shifting Your Mindset About Wealth

Wealth is often thought of in monetary terms, but it encompasses much more. It includes your unique gifts, skills, and the impact you can make in the lives of others. When you align your purpose with your actions, financial rewards often follow.

Believing that what you have to offer is valuable is essential. Once you acknowledge your expertise, the next step is finding ways to share it with others. This is where the transformation occurs—when your knowledge addresses someone else’s needs, it creates a mutually beneficial exchange.

Practical Steps to Turn Your Expertise Into Income

1. Identify Your It Factor: Consider the skills and knowledge you have that others might find helpful. Think about your professional background, personal interests, and experiences that set you apart.

2. Package Your Knowledge: Explore different formats for delivering your expertise. This could be an online course, a coaching program, a book, or digital products. The key is to present your knowledge in a way that is accessible and actionable for your audience.

3. Start Small and Scale Up: You don’t need to have everything figured out initially. Begin with a simple offer that you can test and refine. Gather feedback and adjust your approach to meet the needs of your audience.

4. Use Social Proof: Share testimonials or success stories from those who have benefited from your expertise. This builds trust and credibility, demonstrating the value you provide without sounding overly promotional.

5. Consistency is Key: Showing up regularly is crucial. Whether you’re creating content, engaging with your audience, or refining your offerings, consistency helps establish you as a reliable resource in your field.

The Power of Click To Cash

Remember, this journey isn’t about quick fixes; it’s about building a sustainable foundation for long-term success. The Click To Cash philosophy is about taking strategic steps to convert your knowledge into income, allowing you to create a fulfilling life while making a meaningful impact on others.

If you’re interested in exploring more resources and strategies for transforming your expertise into a steady income, I invite you to visit www.stevii.com. Here, you’ll find a wealth of information to help you embark on this exciting journey.

The power to create the life you love lies within you. It’s time to take that next step and turn your knowledge into cash!

-

Featured1 year ago

Featured1 year ago20 Entrepreneurs to Watch Closeout 2024

-

Innovation2 years ago

Innovation2 years agoLeo Horacio: A Successful Entrepreneur in the Ecommerce and Online Sales Industry

-

Innovation2 years ago

Innovation2 years agoInnovators in Social-Emotional Learning: Dr. Myava Clark and Chris Clark Jr.

-

Music2 years ago

Music2 years agoArtist Deydee Signs $350,000 Contract with Rueda Empire LLC

-

Latest2 years ago

Latest2 years agoCharles zhang recognized by forbes as #1 on michigan’s 2022 best in state wealth advisor list

-

Uncategorized1 year ago

Uncategorized1 year agoTrailblazer in Business: Alicia Fitts on Building Wealth and Community Through Faith

-

Latest1 year ago

Latest1 year agoFlorida Gov DeSantis signs 15-week abortion ban | Latest News

-

Lifestyle2 years ago

Lifestyle2 years agoPhillip Austin brings outlaw country to General Duffy’s stage – The Bulletin