Featured

What Canned Cocktails & Rental Cars Teach Us About Equality In Taxation – Forbes

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius.

Former President Trump dodged a question Thursday on whether he would sign a national 15-week abortion ban as 2024 Republican contenders are facing increasing pressure to clarify their stance on curtailing abortion access at the federal level.

During an interview with New Hampshire-based WMUR, Trump was asked if he would sign a 15-week abortion ban that’s been proposed by Sen. Lindsey Graham (R-S.C.), if he were elected president again.

“Well, we’re going to look at it. We’re looking at a lot of different options. We got it back to the States. We did the Roe v. Wade thing, which they’ve been trying to get it done for 50 years,” Trump said, referring to the Supreme Court’s decision last year to eliminate the federal right to an abortion.

Trump touted the three conservative Supreme Court justices he nominated to the high court, while adding “we’ll get something done where everyone is going to be very satisfied.”

Pressed again about action at the national level, the former president said, “I think we’ll get it done on some level. It can be on different levels, but we’re going to get it done. I know the issue very well. I think I know the issue better than most and we will get that taken care of.”

Trump’s remarks come as several anti-abortion groups criticized him earlier this month when his campaign released a statement suggesting that he supported having the issue of abortion access settled at the state level.

“Life is a matter of human rights, not states’ rights,” said Marjorie Dannenfelser, president of SBA Pro-Life America.

A number of announced and expected Republican presidential challengers have been pressed on the issue as the 2024 campaign gets underway.

Former Vice President Mike Pence suggested Americans “would welcome a minimum national standard in Washington, D.C., 15 weeks,” while Florida Gov. Ron DeSantis (R) this month signed a six-week abortion ban into law in his home state.

Former South Carolina Gov. Nikki Haley said in a speech this week, “I do believe there is a federal role on abortion,” but didn’t commit to what that restriction should be.

Polling in recent months has shown that a majority of Americans believe abortion should be legal in most, if not all, cases.

Featured

Ron Holloway Is Helping Everyday People Build Wealth Through Land Deals — One Blueprint at a Time

In a world where real estate often feels out of reach for everyday people, Ron Holloway, developer, coach, and founder of New Hope Builders, Inc, is proving that with the right strategy, anyone can get in the game.

With more than two decades of experience, Ron has built a million-dollar empire, closed over eight figures in real estate deals, and developed more than 100 homes across Virginia and beyond. But what truly sets him apart is his passion for teaching others how to do the same—no matter their background or starting point.

“Most people look at an empty lot and just see dirt,” Ron says. “I see opportunity. And my mission is to show people how to turn that dirt into dollars, deals, and legacy.”

From Developer to Educator

Ron’s journey began as a hands-on builder and investor. Over the years, he developed a keen eye for spotting profitable land opportunities—often before anyone else saw the potential. Through trial, error, and strategic planning, he built a thriving business and became known for his ability to break down complex real estate concepts into clear, actionable steps.

Now, through workshops, coaching programs, and his newly released book, Ron is sharing his exact methods with aspiring investors, entrepreneurs, and coaches who want to build wealth through land development.

Launching “From the Dirt to the Keys”

Ron’s new book, From the Dirt to the Keys: The Blueprint to Profitable Land Deals & Dream Homes, officially launched on October 18, 2025, at the Russell Innovation Center for Entrepreneurs in Atlanta, Georgia.

The event was more than a book signing—it was a hands-on workshop where attendees learned how to evaluate land, run profit numbers, and create their own real estate strategies. Ron also introduced his 4-Week Coaching Intensive, designed to help participants put the blueprint into action immediately.

Making Real Estate Accessible

Ron’s approach is refreshingly practical. Instead of overwhelming people with jargon, he focuses on clear steps:

- Step 1: Start with zoning and land fundamentals.

- Step 2: Run quick, realistic numbers.

- Step 3: Know your exit strategy before you buy.

This framework has already helped countless individuals take their first steps toward profitable land deals—many of whom had zero real estate experience beforehand.

A Mission Rooted in Legacy

For Ron, this work is bigger than business. It’s about creating generational wealth and empowering communities to invest strategically.

“My goal is simple,” Ron explains. “I want to make real estate investing accessible. If you have the willingness to learn, I have the blueprint to help you win.”

To learn more about Ron Holloway and get a copy of his new book, visit: www.FromTheDirt2TheKeys.com

Featured

Mother of 7, Dr. DeShonda Jennings, Celebrates Parents & Childcare Heroes at 2025 Childcare Conference

Dr. DeShonda Jennings is more than the loving mother of five — she’s a champion for parents, educators, and childcare professionals. This year, she’s using her platform to spotlight those who care for children every day and to recognize the often-unsung heroes behind early childhood development.

A Heart for Parents & Childcare Professionals

As a mother of five, Dr. Jennings understands firsthand the challenges, triumphs, and sacrifices that go into raising children. She knows how much work it takes — from balancing schedules to seeking quality care — and she wants to use her voice to lift up other parents and those who care for little ones.

This year, she’s leading the way in honoring the people who make childhood possible: the parents, daycare providers, teachers, home-based child care professionals, and others. Through her role in the upcoming Childcare Conference & Award Ceremony, she is calling attention to the dedication, creativity, and heart that these individuals pour into their work.

About the 2025 Childcare Conference & Award Ceremony

The Childcare Conference is designed to uplift, educate, and celebrate those in the childcare space — as well as parents who partner in their children’s growth. The event will feature:

- Powerful keynote sessions

- Breakout workshops on business, leadership, funding, family engagement, and more

- VIP sessions (like getting Grant & Funding strategies)

- Networking with peers, experts, and advocates

- An awards ceremony unveiling honorees across multiple categories

Speakers, including Dr. Jennings, will dive into topics such as:

- Bridging parent–professional partnerships

- Financial strategies for childcare programs

- Leadership in early childhood settings

- Navigating current trends in childcare and education

The conference also offers two ticket tiers:

- General Admission — $147 (includes conference access, lunch, networking, vendor access) childcareconference.org

- VIP Ticket — $297 (includes VIP seating, VIP luncheon, special breakout sessions, swag, and more) childcareconference.org

VIP seats are limited, so early registration is encouraged. childcareconference.org

A hotel block is available at Four Points by Marriott / Sheraton near Richmond Airport, allowing attendees to stay close to the venue and local attractions. childcareconference.org

The Awards — Recognizing Excellence from All Corners

One of the highlights of this conference is the Awards for Childcare Excellence — a red carpet event that honors both childcare professionals and parents. Categories include:

- Infant Teacher of the Year

- Toddler Teacher of the Year

- Pre-K Teacher of the Year

- Early Childhood Educator of the Year

- Childcare Professional of the Year

- Home Day Care Leadership

- Family Day Home Leadership

- Homeschool Educator

- And others childcareconference.org

Nominations open now and run through September 30, 2025. childcareconference.org Voting begins July 1, 2025. childcareconference.org While voting helps gauge interest, final recipients are chosen based on how well the nominees meet the criteria, not just popularity. childcareconference.org

To receive an award, nominated individuals must attend the conference — awards will not be mailed. childcareconference.org

Why Dr. Jennings’s Role Matters

By centering her story — as a mother of five — Dr. Jennings gives this event personal weight. She helps bridge the worlds of parent and professional, showing that strong childcare is a community responsibility. Her leadership and visibility bring attention and credibility to those often working behind the scenes.

Her keynote will not only inspire those in attendance, but also remind all participants — whether parent or provider — that they are seen, appreciated, and essential.

How to Get Your Ticket & Be Part of This Celebration

To join the conference and awards, people can purchase tickets via the official site: childcareconference.org.

(That’s where you can nominate someone, check workshop schedules, and reserve your spot.) childcareconference.org

Invitation is open to:

- Parents

- Daycare providers

- Home-based childcare professionals

- Educators

- Community leaders supporting families and early education

Whether you want to learn, connect, or receive recognition — this is your opportunity.

Featured

Paris Fashion Week 2025: A Season of Bold Reinvention

Paris Fashion Week 2025 has arrived with more than just glamour on the runway—it’s signaling a major turning point for the global fashion industry. From leadership shakeups at legendary fashion houses to fresh strategies aimed at reviving sluggish luxury sales, this season is less about tradition and more about transformation.

Creative Leadership Takes Center Stage

This year, all eyes are on Chanel and Dior. Both brands, known for defining eras of elegance, are under new creative leadership for the first time in years. Each debut brought its own energy. Chanel leaned into sharp tailoring and minimalist detailing—a shift from the romanticism of past collections—while Dior stunned audiences with bold silhouettes and cultural references that hinted at a more global, forward-thinking vision.

The shakeup isn’t just about aesthetics. Insiders say these leadership changes reflect a broader push to attract a new generation of buyers who value innovation, diversity, and purpose as much as luxury.

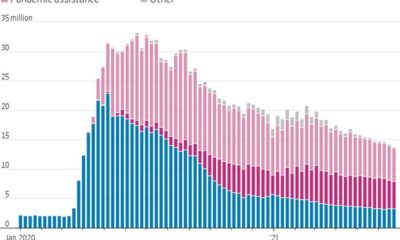

Post-Pandemic Pressures Push Brands to Adapt

Beyond the catwalk, the luxury market is facing a reality check. The post-pandemic boom that lifted sales in 2021 and 2022 has slowed, leaving many major houses reevaluating their business models. Rising production costs, changing consumer values, and a global shift toward sustainability have forced brands to rethink how they connect with their audiences.

Some are experimenting with smaller, more curated fashion shows aimed at creating intimate, immersive experiences. Others are merging fashion with technology, offering digital collections, augmented reality previews, and interactive shopping platforms to keep younger consumers engaged.

Luxury Meets Purpose

One of the most noticeable themes this season is intentionality. Several emerging designers used their runway shows to highlight social issues—from climate change to cultural preservation—making it clear that fashion in 2025 is not just about what you wear, but what it represents. Even established houses are weaving more storytelling and purpose-driven messaging into their presentations.

A Pivotal Season for Global Fashion

Paris Fashion Week has always been the heartbeat of style, but this year, it feels more like a strategic summit than a celebration. Brands are no longer just competing on creativity—they’re racing to stay relevant in a rapidly evolving world. With leadership changes at the top, shifting consumer expectations, and new approaches to business, Paris Fashion Week 2025 may be remembered as the moment fashion stopped looking back and started shaping its future.

-

Featured1 year ago

Featured1 year ago20 Entrepreneurs to Watch Closeout 2024

-

Innovation1 year ago

Innovation1 year agoLeo Horacio: A Successful Entrepreneur in the Ecommerce and Online Sales Industry

-

Latest1 year ago

Latest1 year agoCharles zhang recognized by forbes as #1 on michigan’s 2022 best in state wealth advisor list

-

Music1 year ago

Music1 year agoArtist Deydee Signs $350,000 Contract with Rueda Empire LLC

-

Innovation1 year ago

Innovation1 year agoInnovators in Social-Emotional Learning: Dr. Myava Clark and Chris Clark Jr.

-

Lifestyle2 years ago

Lifestyle2 years agoPhillip Austin brings outlaw country to General Duffy’s stage – The Bulletin

-

Latest1 year ago

Latest1 year agoFlorida Gov DeSantis signs 15-week abortion ban | Latest News

-

Uncategorized11 months ago

Uncategorized11 months agoTrailblazer in Business: Alicia Fitts on Building Wealth and Community Through Faith